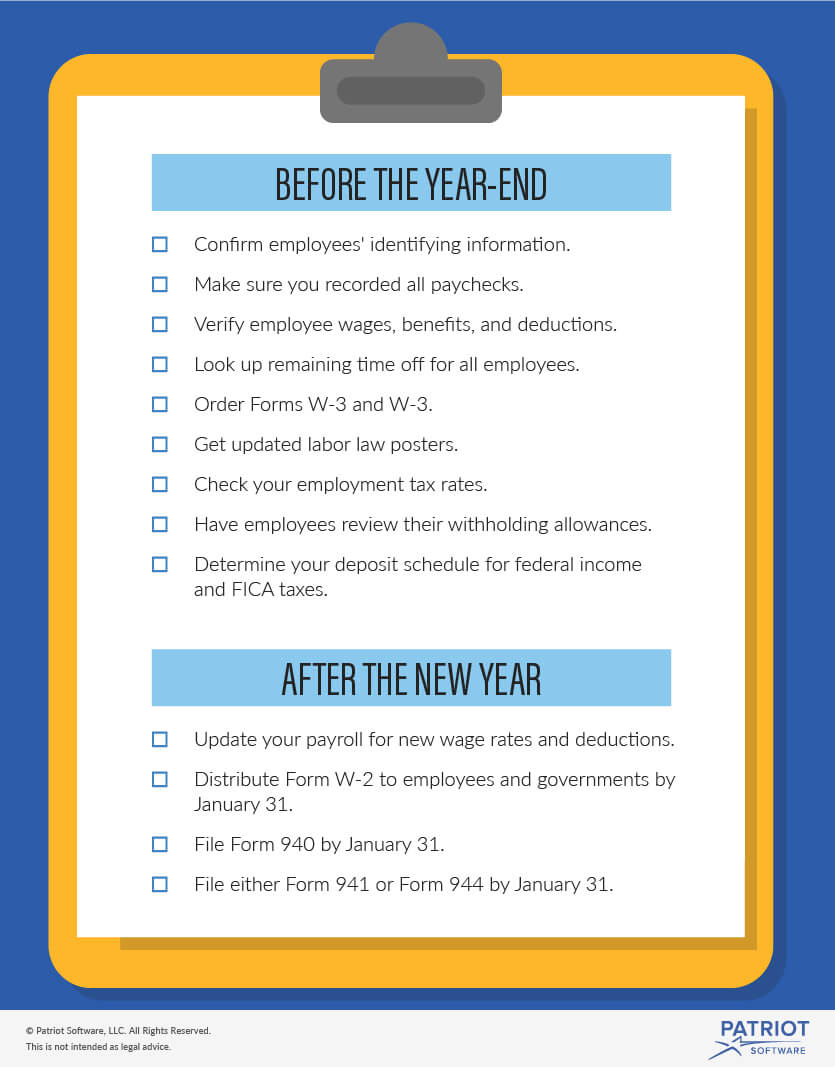

One year is ending and another is beginning. It’s a time for wrapping tasks up and starting new things. This includes your payroll. At the end and beginning of each year, there are certain payroll requirements you must complete. Use this end-of-year payroll checklist to complete all your payroll tasks on time. The first section lists payroll year-end procedures you should finish before the year ends. The second section lists things you should do at the beginning of the next year.

Before the end of the year

Complete the following tasks before the year ends.

- Confirm identifying information for all employees. This includes each employee’s full legal name, Social Security number, and current address of residence. You should already use this information when you run payroll. It’s especially important to have this information correct on each employee’s Form W-2. A missing or incorrect name or Social Security number can lead to penalties.

- Make sure all paychecks from the year are correctly recorded. Be sure to include all payments for commissions, bonus pay, or anything run outside of the normal payroll. All handwritten checks must be included. Also, make sure you accurately recorded any voided paychecks.

- Verify that employee wages, benefits, and deductions are correct. Make sure you have the correct pay rate listed for each employee. Double check each employee’s benefits and their deductions. Check other employee deductions, such as child support withholding, to make sure you are withholding the right amounts.

- Look up sick days, vacation time, and any other permitted time off. For each employee, see how many days are used and how many remain. Find out if employees want to roll over the time to next year or cash it out. Or, if you have a use-it-or-lose-it policy, notify employees of how much time they have left and when they need to use it by. What employees can do will depend on your business’s policies.

- Order Forms W-2 and W-3 as part of your payroll end-of-year checklist. You can buy these forms from the IRS or another authorized provider.

- You will distribute Form W-2 to your employees and federal and state governments at the beginning of the new year. Form W-3 is the transmittal form that gives a summary of all your Forms W-2. You will send Form W-3 to federal and state governments.

- Get updated labor law posters to hang up next year. You must meet both federal and state labor law posting requirements. You might need posters for the Employee Polygraph Protection Act, the Fair Labor Standards Act (FLSA), the Occupational Safety and Health Act, and more. The U.S. Department of Labor poster advisor can help you determine which federal posters you need. Be sure to also check state and local laws.

- Check your tax rates for federal, state, and local taxes. Tax rates are typically updated on an annual basis. You should check your rates for the following taxes:

- Federal income tax

- Federal unemployment tax (FUTA tax)

- FICA taxes (Social Security and Medicare taxes)

- State income tax

- State unemployment tax (SUTA tax)

- Local income tax

- Have your employees review their withholding allowances for federal and state income tax withholdings. For federal income tax, employees will indicate their withholding allowances on Form W-4. For state income tax withholding, employees might need to fill out an additional state withholding allowances form.

- Determine your next year’s deposit schedule for federal income tax and FICA taxes. You must pay these taxes on a monthly or semiweekly basis. Your deposit schedule is based on a lookback period. Your deposit schedule can change every year, so make sure you determine your schedule before the beginning of the new year.

After the new year

Your payroll year-end checklist doesn’t finish when one year ends. Some tasks carry over into the next year.

- Update your payroll to reflect any new wage rates, withholding allowances, and other deductions. This information should be correct when you run the first payroll of the new year.

- Give a Form W-2 to each employee by January 31. Employees will use this to file their individual tax returns.

- You must file a Form W-2 for each employee with the Social Security Administration. You might also need to send Forms W-2 to state and local governments. You must also file Form W-3, the transmittal form. File these forms by January 31.

- Some taxes from the previous year are filed in the new year.

- You need to file your FUTA taxes on Form 940 by January 31. Your fourth quarter FUTA taxes are also due by January 31.

- You must also file your federal income taxes and FICA taxes in the new year. Both the quarterly Form 941 and the annual Form 944 are due by January 31.

=====

Mike Kappel, serial entrepreneur and CEO of Patriot Software, offers payroll advice from more than 20 years of experience to small business owners.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs